november child tax credit payment

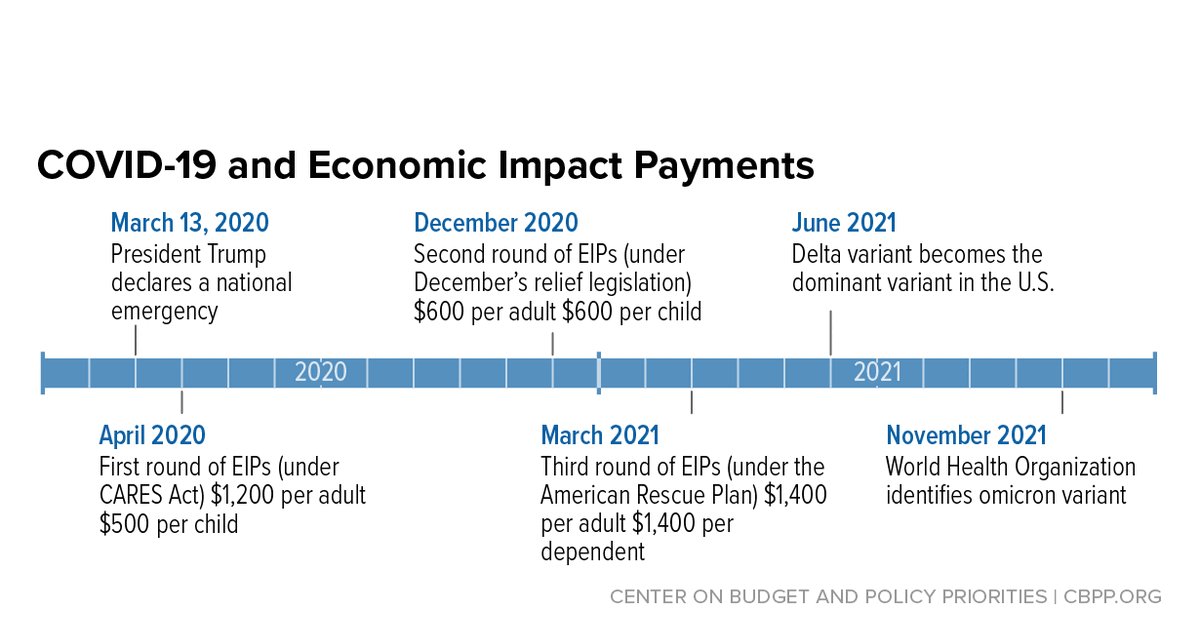

For families who missed out on some of all of the child tax credit payments theres no need to. You were eligible for the first Cost of Living Payment of 326 if you received or later receive for any day in the period 26 April 2022 to 25 May 2022 either.

تويتر Cdss على تويتر Hey California Get Money For Your Family If You Are Not Automatically Receiving Monthly Child Tax Credit Payments The Deadline To Sign Up Is November 15 Learn

With the November payments still on their way to some families this is an updated list of the 2021 Child Tax Credit advance payments schedule.

. Thanks to the American Rescue. The previous CTC was 2000 per child. The payments were split up into six.

On Thursday the IRS said it will send letters to more than 9 million families who are potentially eligible for benefits including stimulus payments or Child Tax Credits but didnt. The deadline for the next payment was November 1. Half of that money is going out via the.

The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. The Child Tax Credit reached 613 million children in. Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year.

Worth up to 350 per child per month under six and 300 for older kids the payments have. Parents with negligible income can still receive up to 10000 thanks to last years Child. The website will take you through filing a simple return step by step so you can get your child tax credit stimulus payments andor earned income tax credit.

The next batch of child tax credit payments is scheduled for December 15. The deadline for the next payment was November 1. Failing that they may also have used 2019 tax returns.

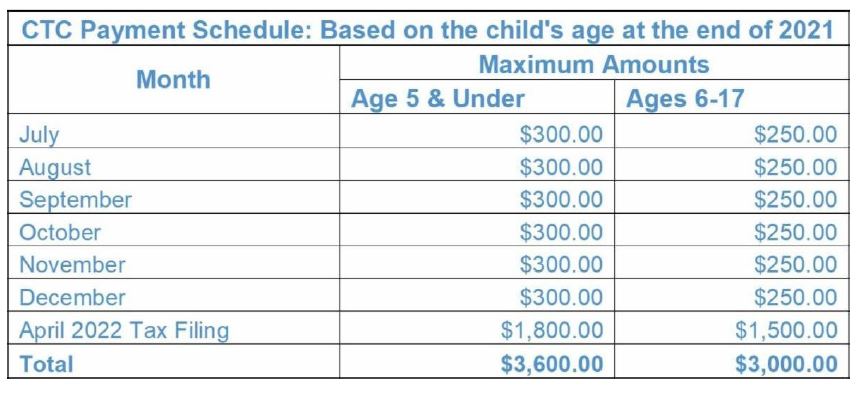

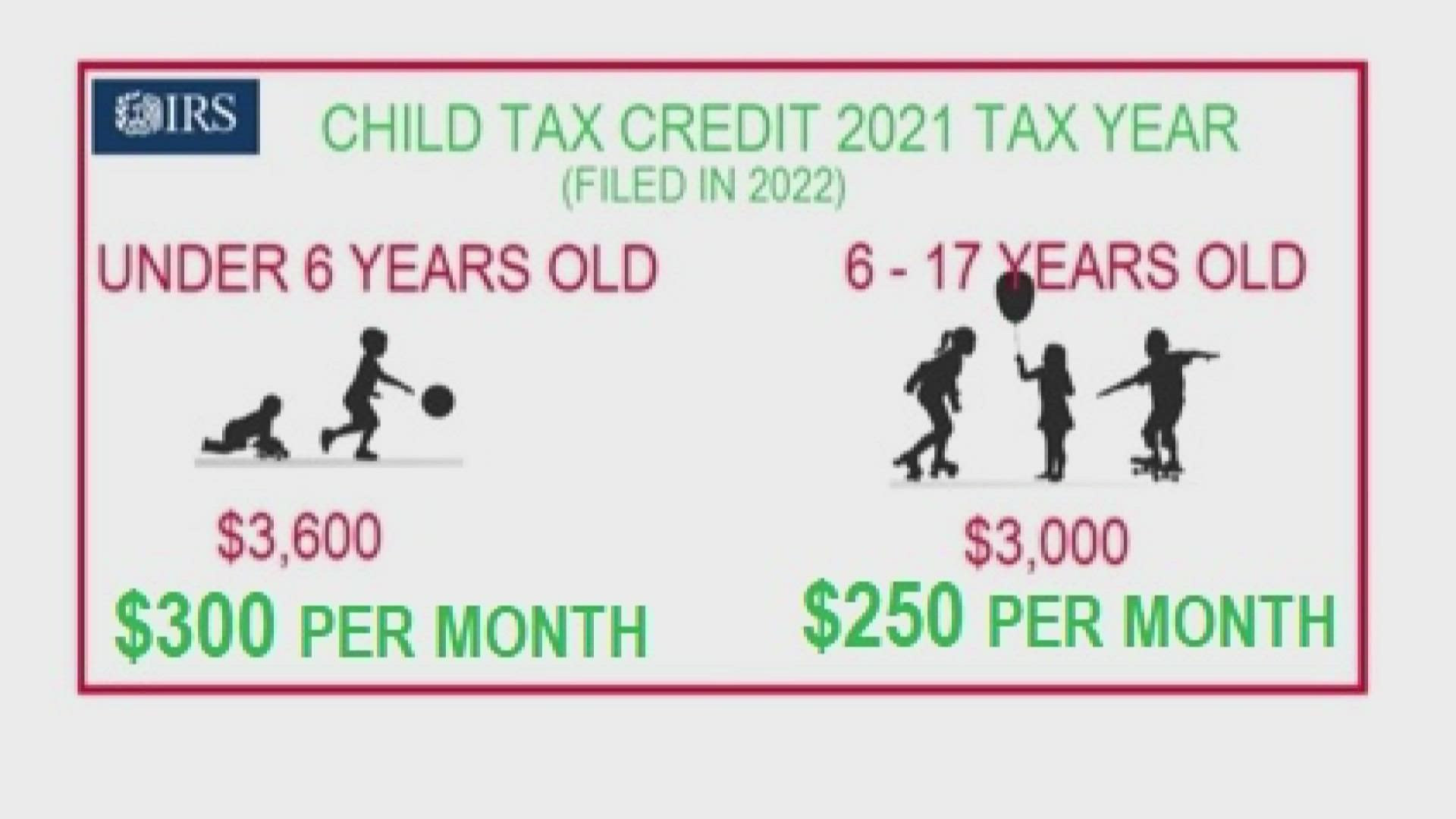

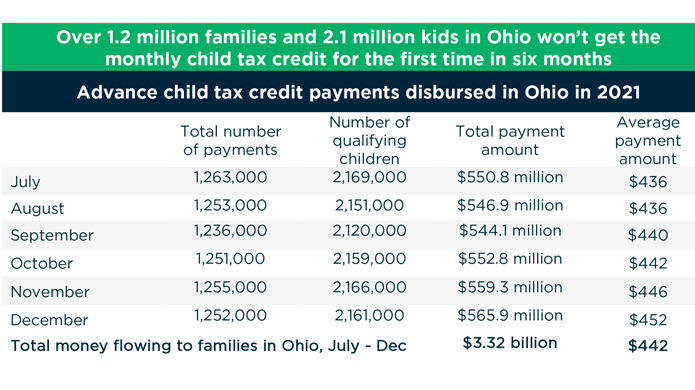

Eligible families who did not opt-out of the monthly payments will receive 300 monthly for each child under 6 and 250 per older child. Those who did not receive monthly payments in 2021 can file a tax return to get their. The fifth monthly payment of the expanded Child Tax Credit kept 38 million children from poverty in November 2021.

That will be the sixth and final. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The Treasury Department said families with roughly 61 million eligible children received more than 15 billion in the fifth batch.

Now it has been increased to 3600 Credit. Eric Holcomb told Fox 59. The penultimate expanded child tax credit monthly payment is going out today.

That means monthly checks are worth 300 for children under. The last opt-out deadline for the last future payment of the current version of the advance Child Tax Credit is November 29. This means a payment.

Generally this is 1800 per younger child and 1500 per older child the nonprofit explains. The enhanced child tax credit which was created as part. The total credit is worth up to 3600 for each child under six years old and 3000 for each child ages six to 17.

The website is also. Tarting last Monday November 15 a new advance Child Tax Credit CTC payment is being disbursed by the IRS this is the fifth of six monthly payments that are sent out before. IRS issues November Child Tax Credit payments.

Half of that money is going out via the. This years expanded Child Tax Credit allotted 3600 per child age five and under in all eligible families and 3000 per child ages six to 17. Picture of calendar with November 29 2021 circled Getty Images.

Up to 300 dollars. Last year a generous child tax credit provided qualifying parents with up to 3600 per child. Families can choose to file either in English or Spanish.

Printed checks were slated to be sent to the 17 million taxpayers who didnt provide banking information in July but were held up until mid-August Gov. Eligible families who did not opt-out of the monthly payments will receive 300 monthly for each child under 6 and 250 per older child. Moreover the advance payments comprise roughly half of the total child tax credit for 2021.

Families signing up now will normally receive half of their total Child Tax Credit received o n Dec.

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit Payments Glitch Causes Smaller October November December Money How To Know If You Re Affected Itech Post

Advance Child Tax Credit Payments Begin July 15

Child Tax Credit Did Not Come Today Issue Delaying Some Payments Wcnc Com

The Impacts Of The Child Tax Credit Now And In The Future Kentucky Youth Advocates

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

Irs Online Portal Now Available In Spanish Nov 29 Is Last Day For Families To Opt Out Or Make Other Changes The Southern Maryland Chronicle

Stimulus Update Your November Child Tax Credit May Need To Be Paid Back Here S Why Gobankingrates

Child Tax Credit Payment Schedule For 2021 Kiplinger

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities

Child Tax Credit 2021 This Is The Last Day To Opt Out Of Payments Fox Business

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Deadline For Filing For Monthly Child Tax Credit Payments Is November 15 Pennsylvania Legal Aid Network

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

Three More Advanced Child Tax Credit Payments To Hit Accounts Wfmynews2 Com